Server APIs

Overview

Our server adapts REST archetype, so all requests are sent using HTTP POST.

Payment Method Definitions

To help developers understand which fields apply to specific transaction types, the following defines what “Direct Pay”, “Electronic Payment (E-payment)”, and “Token Pay” refer to in TapPay APIs.

Direct Pay

Definition:

Direct Pay refers to transactions where customers enter their credit card information directly on the merchant’s frontend to make a payment through TapPay’s payment gateway.

E-Payment

Definition:

E-payment refers to transactions made through e-wallet accounts. Include: LINE Pay, JKOPay and Easy Wallet etc., please refer to the e-payments support list for all supported e-payments.

Supported fields and behaviors vary by e-payment providers.

Token Pay

Definition:

Token Pay exclusively refers to transactions made with tokenized credit cards provisioned by mobile wallets (Apple Pay, Google Pay, Samsung Pay).

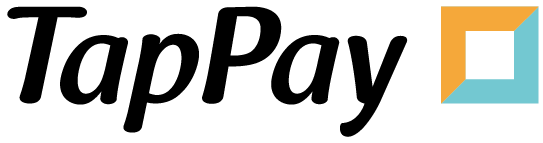

Pay by Prime API

The data flow of non-3D secure transaction

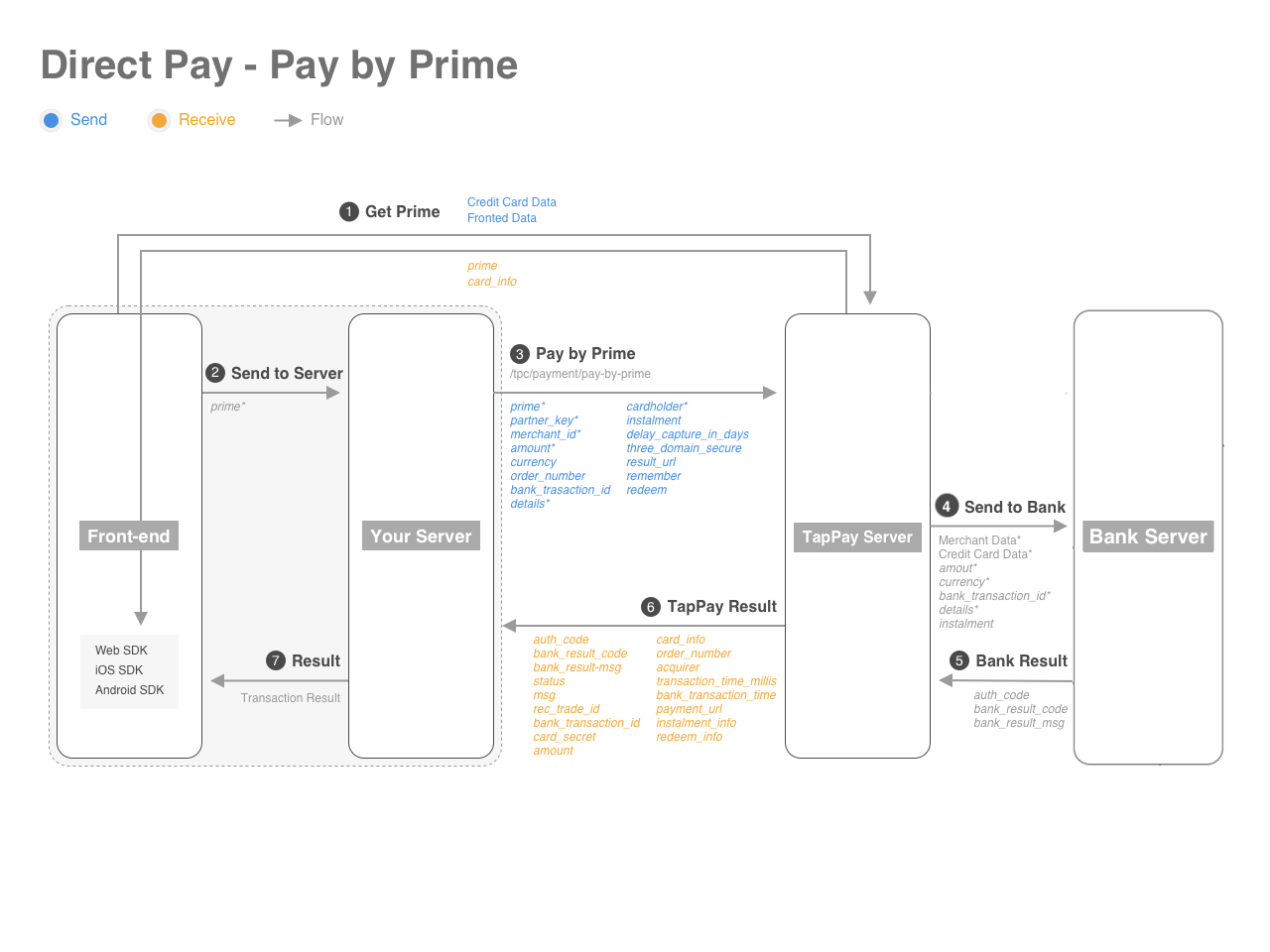

The data flow of 3D secure transaction

If you would like to execute a 3D secure transaction, please fill in “true” in the value of “three_domain_secure”, and fill in corresponding value of “frontend_redirect_url” and ” backend_notify_url”.

To avoid the condition which transaction status is inconsistent with TapPay system due to unsuccessful receipt of our Backend Notify, it is recommended that after receiving the frontend redirect url from TapPay and before displaying the transaction result page to the consumer on the front end, you can call the Record API (use rec_trade_id as the search criteria) to check the latest transaction result.

- This API allows you to pay using the prime token obtained from your Frontend.

- The prime token may only be used once, so you need to create a new token everytime before you call this API.

- If the parameter “remember” is set as true, you will get the card_key and card_token in the Pay by Prime API response. You can directly use them to call Pay by Card Token API, so that you can pass the step of createToken. After saving card_key and card_token, you can call Pay by Card Token API to handle recurring transaction on every fixed date or period with fixed amount that you set in your system. This feature doesn’t support Apple Pay, Google Pay, Samsung Pay, JKOPAY, Easy Wallet, Atome, Pi Wallet, Plus Pay.

- To ensure your information is correct, please set your timeout to 30 seconds.

| Name(* = required.) | Type(Max) | Usage | ||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| prime* | String(71) | The one time token returned from getPrime. The prime will be expired after 90 seconds. If using Apple Pay Deferred Payments, please keep prime by yourself.(The duration of each prime is set up for 30 days as default.) You can use test prime for test in sandbox environment. |

||||||||||||||||||||||||||||||||||||

| partner_key* | String(64) | Authentication key for each individual partner. | ||||||||||||||||||||||||||||||||||||

| merchant_id* | String(50) | Involved merchant’s identifier as defined on Portal. | ||||||||||||||||||||||||||||||||||||

| merchant_group_id | String(50) | The merchant management settings set on the portal, transactions will be performed according to the portal’s payment configuration during the transaction. Cannot be used with merchant_id at the same time. |

||||||||||||||||||||||||||||||||||||

| amount* | int | Transaction price. Except TWD, transaction price should times 100. For instance, if transaction price is HKD1, please fill in 100 in this parameter. Please see the reference for each foreign currency’s transaction limit. When using AFTEE for transactions, the maximum amount allowed is NT$9,999,999. |

||||||||||||||||||||||||||||||||||||

| merchandise_details | JSONObject | The item amount or points that are excluded from redeems. Only supported by some e-payments. Please refer to the e-payments support list. | ||||||||||||||||||||||||||||||||||||

| currency | String(3) | Transaction currency. Format follows the ISO 4217 alphabetic code, e.g., TWD. Refer to the reference for currencies supported by the bank. | ||||||||||||||||||||||||||||||||||||

| order_number | String(50) | A self-defined identifier for each transaction, for TapPay to identify transaction. This parameter doesn’t allow null. | ||||||||||||||||||||||||||||||||||||

| bank_transaction_id | String(40) | Transaction identifier for the bank. You may customize one here if you wish, but it must be unique. We strongly recommend you to define the unique bank_transaction_id by yourself to avoid error 421: gateway time out. Please refer to the reference for its format rule. |

||||||||||||||||||||||||||||||||||||

| details | String(100) | Item description. Required for PCI compliance. If acquirer supports, this field will be forwarded by TapPay. This field is required by some acquirers. If omitted, the transaction may fail. Format requirements vary by acquirer, so please refer to reference for more details |

||||||||||||||||||||||||||||||||||||

| cardholder* | JSONObject | Information of the cardholder, optional fields may be left blank. The following information feeds the “Fraud Detector” and “3-D Secure risk verification”.

|

||||||||||||||||||||||||||||||||||||

| cardholder_verify | JSONObject | Authentication Fields. Note: If this transaction requires identity authentication (KYC), you must provide required cardholder informations in cardholder field, please refer to the Reference of cardholder description for each acquirer required. If a field is marked as “true”, the information corresponding to the cardholder field will be sent to the acquirer for identity authentication (KYC). To perform two-step identity authentication (KYC), please ensure that you enter your Merchant ID from the KYC verification merchant settings found in Merchant Management > KYC in the Portal into the kyc_verification_merchant_id field.If using an AE card for identity authentication (KYC), a charge of 1 dollar will be deducted and refunded within two weeks. If you need to test identity authentication (KYC) transaction in sandbox environment, please refer national id and phone number for testing. Supported: Direct Pay There are two usage scenarios as follows:

|

||||||||||||||||||||||||||||||||||||

| kyc_verification_merchant_id | String | The merchant id can only do authentication except authorization. Support Industry : property and life insurance industry / electronic payment industry |

||||||||||||||||||||||||||||||||||||

| instalment | int(2) | Number of intervals of payments for a particular transaction. Default set this value as 0. Support: Taishin Bank, National Credit Card Center of R.O.C., NewebPay, Cathay United Bank, E.SUN BANK, CTBC BANK, globalpayments, UNION BANK OF TAIWAN Only Support: Direct Pay |

||||||||||||||||||||||||||||||||||||

| delay_capture_in_days | int | The number of days between the time bank authorizes the payment and the time bank actually captures the payment. Default is 0. If you wish to capture the payment yourself, use -1 as the value to disable automatic capture. Each acquiring bank has its capture deadline, please confirm with your acquiring bank before deciding your capture period. Be aware that your captures might be failed if you didn’t complete the capture by the banks capture deadline. |

||||||||||||||||||||||||||||||||||||

| three_domain_secure | Boolean | Enable 3D Secure authentication. Default is false. Only applicable to Direct Pay. Refer to Reference for supported banks. |

||||||||||||||||||||||||||||||||||||

| result_url | JSONObject | Transaction result notification URL. Required for e-payment and Direct Pay 3D transactions (when three_domain_secure = true)

|

||||||||||||||||||||||||||||||||||||

| redeem | boolean | Whether to use the redeem. Support: National Credit Card Center of R.O.C. Only Support: Direct Pay |

||||||||||||||||||||||||||||||||||||

| remember | boolean | Indicates whether to store this payment method. If set to true, the response will return a card_secret (card_key and card_token), which can be used for future Pay by Card Token API transactions. Supported only for Direct Pay and some e-payments with binding transaction support. Please refer to the e-payments support list. | ||||||||||||||||||||||||||||||||||||

| additional_data | JSONString(3000) | Data will be encrypted and decrypted when other customization requirements. | ||||||||||||||||||||||||||||||||||||

| event_code | String(50) | A code which be defined by the bank, E-Wallet and merchants. Support: Easy Wallet, iPass Money |

||||||||||||||||||||||||||||||||||||

| product_image_url | String(500) | The picture of the store or the product on the pay page.The feature of this parameter is same as line_pay_product_image_url. However, if you set both product_image_url and line_pay_product_image_url in the request, we will use the url in product_image_url.Please refer to the reference page to see the rule of each supported partners. | ||||||||||||||||||||||||||||||||||||

| jko_pay_insurance_policy | StringArray | JKOPAY insurance details of property and life insurance transaction Support: JKOPAY The parameters below are required when doing the property and life insurance transaction via JKOPAY.

|

||||||||||||||||||||||||||||||||||||

| store_id | String(10) | Store branch ID. If supported by the acquirer, this field will be forwarded. See reference for supported format/ acquirer. | ||||||||||||||||||||||||||||||||||||

| store_name | String(50) | Store name. If supported by the acquirer, this field will be forwarded. See reference for supported format/ acquirer. |

// *** Format ***

// Sandbox URL: https://sandbox.tappaysdk.com/tpc/payment/pay-by-prime

// Production URL: https://prod.tappaysdk.com/tpc/payment/pay-by-prime

// Header:

// Content-Type: application/json

// x-api-key: YourPartnerKey

{

"prime": String,

"partner_key": String,

"merchant_id": "merchantA",

"details":"TapPay Test",

"amount": 100,

"cardholder": {

"phone_number": "+886923456789",

"name": "Jane Doe",

"email": "Jane@Doe.com",

"zip_code": "12345",

"address": "123 1st Avenue, City, Country",

"national_id": "A123456789"

},

"remember": true

}

Response

| Name | Type(Max) | Usage | ||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| status | int | Response code. 0 indicates success. | ||||||||||||||||||||||||||||||||||||

| msg | String | Error message. | ||||||||||||||||||||||||||||||||||||

| rec_trade_id | String(20) | Unique identifier for this transaction generated by our server. | ||||||||||||||||||||||||||||||||||||

| bank_transaction_id | String(40) | Transaction identifier for the bank. You may customize one here if you wish, but it must be unique. We strongly recommend you to define the unique bank_transaction_id by yourself to avoid error 421: gateway time out. Please refer to the reference for its format rule. |

||||||||||||||||||||||||||||||||||||

| bank_order_number | String | Acquirer’s returned order number after authorization. See reference for supported format/ acquirer. | ||||||||||||||||||||||||||||||||||||

| auth_code | String(6) | Authorization code. Supported only for Direct Pay and Token Pay. | ||||||||||||||||||||||||||||||||||||

| card_secret | JSONObject | Payment credential, contains the card key and token. Supported only for Direct Pay and some e-payments with binding transaction support. Please refer to the e-payments support list.

|

||||||||||||||||||||||||||||||||||||

| amount | int | Transaction price. Except TWD, transaction price should times 100. For instance, if transaction price is HKD1, will return 100. |

||||||||||||||||||||||||||||||||||||

| currency | String(3) | Transaction currency. Format follows the ISO 4217 alphabetic code, e.g., TWD. Refer to the reference for currencies supported by the bank. | ||||||||||||||||||||||||||||||||||||

| card_info | JSONObject | Card information. Supported only for Direct Pay and Token Pay.

|

||||||||||||||||||||||||||||||||||||

| order_number | String(50) | A self-defined identifier for each transaction, for TapPay to identify transaction. | ||||||||||||||||||||||||||||||||||||

| acquirer | String | Acquiring banks or payment processors. | ||||||||||||||||||||||||||||||||||||

| transaction_time_millis | long | Time of transaction. | ||||||||||||||||||||||||||||||||||||

| bank_transaction_time | JSONObject | Time when the bank handles the transaction. | ||||||||||||||||||||||||||||||||||||

| bank_result_code | String(40) | Response code from the bank. | ||||||||||||||||||||||||||||||||||||

| bank_result_msg | String(300) | Error message from the bank. | ||||||||||||||||||||||||||||||||||||

| payment_url | String | Payment redirect url, send it to frontend. Not Support : Apple Pay , Google Pay, Samsung Pay. |

||||||||||||||||||||||||||||||||||||

| instalment_info | JSONObject | When use instalment and non 3D transaction will return. Only Support : Direct Pay.

|

||||||||||||||||||||||||||||||||||||

| redeem_info | JSONObject | When use redeem and non 3D transaction will return. Only Support : Direct Pay.

|

||||||||||||||||||||||||||||||||||||

| card_identifier | String | Card identifier. Each credit card corresponds to a unique identifier. Supported only for Direct Pay and Token Pay. | ||||||||||||||||||||||||||||||||||||

| merchant_reference_info | JSON | Merchant reference information

|

||||||||||||||||||||||||||||||||||||

| event_code | String(50) | A code which be defined by the bank, E-Wallet and merchants. Support: Easy Wallet, iPass Money |

||||||||||||||||||||||||||||||||||||

| is_rba_verified | Boolean | If this transaction got the risk score from RBA or not.RBA is able to evaluate the risk of each transaction to recognize and prevent the fraud. This product will be launched soon. Please refer to TapPay official website to know more about RBA. | ||||||||||||||||||||||||||||||||||||

| transaction_method_details | JSONObject | Transaction method details. RBA is able to evaluate the risk of each transaction to recognize and prevent the fraud. This product will be launched soon. Please refer to TapPay official website to know more about RBA.

|

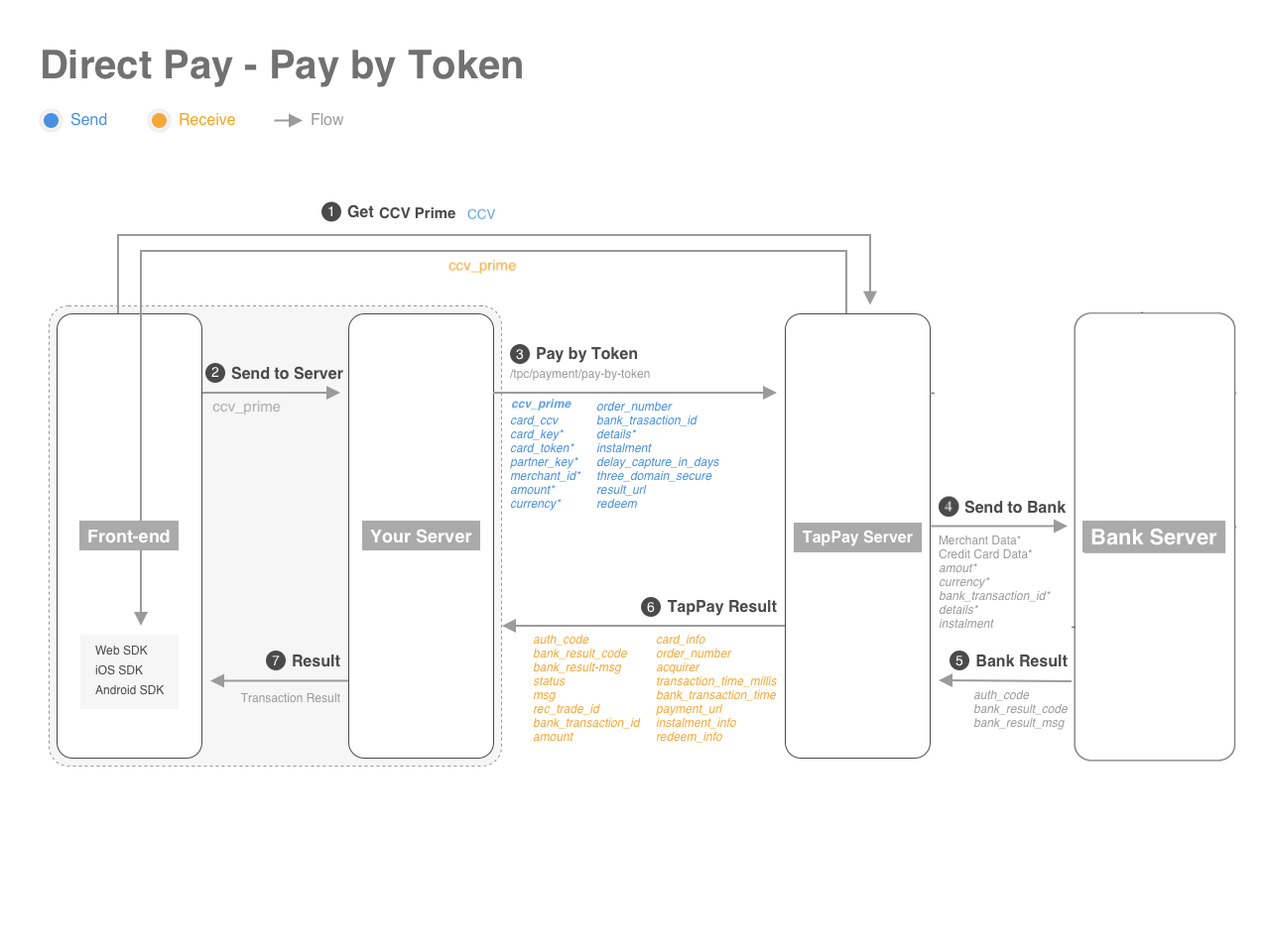

Pay by Card Token API

The data flow of non-3D secure transaction

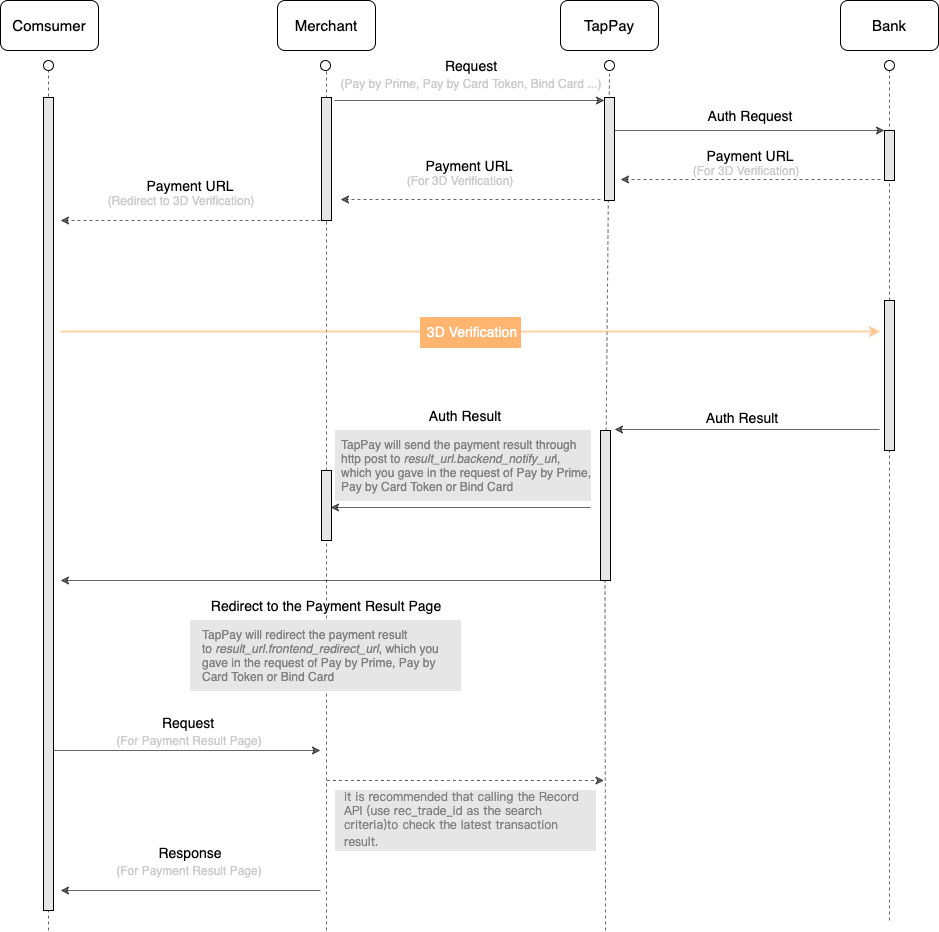

The data flow of 3D secure transaction

If you would like to execute a 3D secure transaction, please fill in “true” in the value of “three_domain_secure”, and fill in corresponding value of “frontend_redirect_url” and ” backend_notify_url”.

This API allows you to pay using a permanent card key and token, thus allowing you to skip the createToken and the payByPrime API.

To avoid the condition which transaction status is inconsistent with TapPay system due to unsuccessful receipt of our Backend Notify, it is recommended that after receiving the frontend redirect url from TapPay and before displaying the transaction result page to the consumer on the front end, you can call the Record API (use rec_trade_id as the search criteria) to check the latest transaction result.

- During peak hour, banks might take longer to process the transaction. To ensure your information is correct, please set your timeout to 30 seconds.

- If the parameter “remember” is set as true, you will get the card_key and card_token in the Pay by Prime API response. You can directly use them to call Pay by Card Token API, so that you can pass the step of createToken. After saving card_key and card_token, you can call Pay by Card Token API to handle recurring transaction on every fixed date or period with fixed amount that you set in your system.

| Name (* = required.) | Type(Max) | Usage | ||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| card_key* | String(64) | Card authorization key. | ||||||||||||||||||||||||||||||||||||

| card_token* | String(67) | Card token. | ||||||||||||||||||||||||||||||||||||

| partner_key* | String(64) | Authentication key for each individual partner. | ||||||||||||||||||||||||||||||||||||

| merchant_id* | String(50) | Involved merchant’s identifier as defined on Portal. | ||||||||||||||||||||||||||||||||||||

| merchant_group_id | String(50) | The merchant management settings set on the portal, transactions will be performed according to the portal’s payment configuration during the transaction. Cannot be used with merchant_id at the same time. |

||||||||||||||||||||||||||||||||||||

| amount* | int | Transaction price. Except TWD, transaction price should times 100. For instance, if transaction price is HKD1, please fill in 100 in this parameter. Please see the reference for each foreign currency’s transaction limit. |

||||||||||||||||||||||||||||||||||||

| currency* | String(3) | Transaction currency. Format follows the ISO 4217 alphabetic code, e.g., TWD. Refer to the reference for currencies supported by the bank. | ||||||||||||||||||||||||||||||||||||

| order_number | String(50) | A self-defined identifier for each transaction, for TapPay to identify transaction. This parameter doesn’t allow null. | ||||||||||||||||||||||||||||||||||||

| bank_transaction_id | String(40) | Transaction identifier for the bank. You may customize one here if you wish, but it must be unique. We strongly recommend you to define the unique bank_transaction_id by yourself to avoid error 421: gateway time out. Please refer to the reference for its format rule. |

||||||||||||||||||||||||||||||||||||

| details | String(100) | Item description. Required for PCI compliance. If acquirer supports, this field will be forwarded by TapPay. This field is required by some acquirers. If omitted, the transaction may fail. Format requirements vary by acquirer, so please refer to reference for more details |

||||||||||||||||||||||||||||||||||||

| cardholder* | JSONObject | Information of the cardholder, optional fields may be left blank. The following information feeds the “Fraud Detector” and “3-D Secure risk verification”.

|

||||||||||||||||||||||||||||||||||||

| cardholder_verify | JSONObject | Authentication Fields. Note: If this transaction requires identity authentication (KYC), you must provide required cardholder informations in cardholder field, please refer to the Reference of cardholder description for each acquirer required. If a field is marked as “true”, the information corresponding to the cardholder field will be sent to the acquirer for identity authentication (KYC). To perform two-step identity authentication (KYC), please ensure that you enter your Merchant ID from the KYC verification merchant settings found in Merchant Management > KYC in the Portal into the kyc_verification_merchant_id field.If using an AE card for identity authentication (KYC), a charge of 1 dollar will be deducted and refunded within two weeks. If you need to test identity authentication (KYC) transaction in sandbox environment, please refer national id and phone number for testing. Supported: Direct Pay There are two usage scenarios as follows:

|

||||||||||||||||||||||||||||||||||||

| kyc_verification_merchant_id | String | The merchant id can only do authentication except authorization. Support Industry : property and life insurance industry / electronic payment industry |

||||||||||||||||||||||||||||||||||||

| instalment | int(2) | Number of intervals of payments for a particular transaction. Default set this value as 0. Support: Taishin Bank, National Credit Card Center of R.O.C., NewebPay, Cathay United Bank, E.SUN BANK, CTBC BANK, globalpayments, UNION BANK OF TAIWAN Only Support: Direct Pay |

||||||||||||||||||||||||||||||||||||

| delay_capture_in_days | int | The number of days between the time bank authorizes the payment and the time bank actually captures the payment. Default is 0. If you wish to capture the payment yourself, use -1 as the value to disable automatic capture. Each acquiring bank has its capture deadline, please confirm with your acquiring bank before deciding your capture period. Be aware that your captures might be failed if you didn’t complete the capture by the banks capture deadline. |

||||||||||||||||||||||||||||||||||||

| three_domain_secure | Boolean | Enable 3D Secure authentication. Default is false. Only applicable to Direct Pay. Refer to Reference for supported banks. |

||||||||||||||||||||||||||||||||||||

| result_url | JSONObject | Transaction result notification URL. Required for e-payment and Direct Pay 3D transactions (when three_domain_secure = true)

|

||||||||||||||||||||||||||||||||||||

| card_ccv | String | Security code. Cannot be used together with ccv_prime. Supported only for Direct Pay. Use this parameter in the following situations: 1. You did not obtain ccv_prime via get-ccv-prime but still want the bank to verify the security code. 2. You did not obtain ccv_prime and are performing a 3DS 2.0 authentication with an AMEX card. |

||||||||||||||||||||||||||||||||||||

| redeem | boolean | Whether to use the redeem. Support: National Credit Card Center of R.O.C. Only Support: Direct Pay |

||||||||||||||||||||||||||||||||||||

| additional_data | JSONString(3000) | Data will be encrypted and decrypted when other customization requirements. | ||||||||||||||||||||||||||||||||||||

| ccv_prime | String | The one time token of security code returned from get-ccv-prime. Cannot be used with card_ccv at the same time. It will be expired after 90 seconds. Support : Direct Pay You can use this ccv_prime for test in sandbox environment ccv_prime(3 digits):test_65b1ca2d5d0dc8ff5b62296ea8547bab08401f8a57015fb818c5bcd10433fa11 ccv_prime(4 digits):test_cd1e737890874cdadf39caaf56c5b183c36a4117ca89cb24fd674c0892e0fa92 |

||||||||||||||||||||||||||||||||||||

| device_id | String(64) | ID of each device. This parameter must be put into the request body when you use the transaction risk analysis sytem of TapPay RBA. To get device ID, please call “Get Device ID ” of TapPay SDK and put it into the Pay by Card Token request body if you use the transaction risk analysis sytem of TapPay RBA.“ |

||||||||||||||||||||||||||||||||||||

| is_merchant_initiated_transaction | Boolean | Indicates whether the transaction is a Merchant-Initiated Transaction (MIT) or a Customer-Initiated Transaction (CIT). Default value is false. MIT scenarios: recurring, subscription transactions etc., true = MIT false = CIT |

||||||||||||||||||||||||||||||||||||

| cardholderinfo_prime | String | Obtain using get-cardholderinfo-prime. |

// *** Format ***

// Sandbox URL: https://sandbox.tappaysdk.com/tpc/payment/pay-by-token

// Production URL: https://prod.tappaysdk.com/tpc/payment/pay-by-token

// Header:

// Content-Type: application/json

// x-api-key: YourPartnerKey

{

"card_key": String,

"card_token": String,

"partner_key": String,

"currency": "TWD",

"merchant_id": "merchantA",

"details":"TapPay Test",

"amount": 100

}

Response

| Name | Type(Max) | Usage | ||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| status | int | Response code. 0 indicates success. | ||||||||||||||||||||||||||||||||||||

| msg | String | Error message. | ||||||||||||||||||||||||||||||||||||

| rec_trade_id | String(20) | Unique identifier for this transaction | ||||||||||||||||||||||||||||||||||||

| bank_transaction_id | String(40) | Transaction identifier for the bank. You may customize one here if you wish, but it must be unique. Please refer to the reference for its format rule. |

||||||||||||||||||||||||||||||||||||

| bank_order_number | String | Acquirer’s returned order number after authorization. See reference for supported format/ acquirer. | ||||||||||||||||||||||||||||||||||||

| amount | int | Transaction price. Except TWD, transaction price should times 100. For instance, if transaction price is HKD1, will return 100. |

||||||||||||||||||||||||||||||||||||

| currency* | String(3) | Transaction currency. Format follows the ISO 4217 alphabetic code, e.g., TWD. Refer to the reference for currencies supported by the bank. | ||||||||||||||||||||||||||||||||||||

| auth_code | String(6) | Authorization code. Supported only for Direct Pay and Token Pay. | ||||||||||||||||||||||||||||||||||||

| card_info | JSONObject | Card information. Supported only for Direct Pay and Token Pay.

|

||||||||||||||||||||||||||||||||||||

| update_cardholderinfo_result | JSONObject | If the update is successful, the system will return the latest cardholder information in the correct format with masking applied. If no cardholder information is provided or the update is not performed, an empty string will be returned

|

||||||||||||||||||||||||||||||||||||

| order_number | String(50) | A self-defined identifier for each transaction, for TapPay to identify transaction. | ||||||||||||||||||||||||||||||||||||

| acquirer | String | Acquiring banks or payment processors. | ||||||||||||||||||||||||||||||||||||

| transaction_time_millis | long | Time of transaction. | ||||||||||||||||||||||||||||||||||||

| bank_transaction_time | JSONObject | Time when the bank handles the transaction. Please refer to the reference for its format rule. |

||||||||||||||||||||||||||||||||||||

| bank_result_code | String(40) | Response code from the bank. | ||||||||||||||||||||||||||||||||||||

| bank_result_msg | String(300) | Error message from the bank. | ||||||||||||||||||||||||||||||||||||

| payment_url | String | Payment redirect url, send it to frontend. Not Support: Apple Pay, Google Pay, Samsung Pay |

||||||||||||||||||||||||||||||||||||

| instalment_info | JSONObject | When use instalment and non 3D transaction will return. Only Support: Direct Pay

|

||||||||||||||||||||||||||||||||||||

| redeem_info | JSONObject | When use redeem and non 3D transaction will return. Only Support: Direct Pay

|

||||||||||||||||||||||||||||||||||||

| card_identifier | String | Card identifier. Each credit card corresponds to a unique identifier. Supported only for Direct Pay and Token Pay. | ||||||||||||||||||||||||||||||||||||

| merchant_reference_info | JSON | Merchant reference information

|

||||||||||||||||||||||||||||||||||||

| is_rba_verified | Boolean | If this transaction got the risk score from RBA or not.RBA is able to evaluate the risk of each transaction to recognize and prevent the fraud. This product will be launched soon. Please refer to TapPay official website to know more about RBA. | ||||||||||||||||||||||||||||||||||||

| transaction_method_details | JSONObject | Transaction method details. RBA is able to evaluate the risk of each transaction to recognize and prevent the fraud. This product will be launched soon. Please refer to TapPay official website to know more about RBA.

|

Frontend Redirect

After an e-payment or Direct Pay 3D transaction is completed, TapPay will redirect the user to the URL specified in frontend_redirect_url in the request. TapPay will include four parameters related to the transaction result.

Request Header

| Key | Value |

|---|---|

| Content-Type | html/text |

Request Url

https://your.domain.com/transaction_is_done?

rec_trade_id=LN20171109WsvKhn&

order_number=CF46019917&

status=0&

bank_transaction_id=TP20171109WsvKhn

Request Query String

| Name | Type | Usage |

|---|---|---|

| rec_trade_id | String | Unique identifier for this transaction generated by our server. |

| order_number | String | A self-defined identifier for each transaction. This parameter doesn’t allow null. |

| bank_transaction_id | String | Transaction identifier for the bank. You may customize one here if you wish, but it must be unique. We strongly recommend you to define the unique bank_transaction_id by yourself to avoid error 421: gateway time out. Please refer to the reference for its format rule. |

| status | Int | Response code. 0 indicates success. |

Frontend redirect could be faked , we suggest you to implement backend notify , If backend notify fail , please use Record API for verifying.

Backend Notify

- After an e-payment or Direct Pay 3D transaction is completed, TapPay will automatically send a backend notification to the URL specified in backend_notify_url in the request.

- If you didn’t receive our Backend Notify successfully (not response HTTP 200), TapPay would resend it again every 1, 2, 4, 8, 16 minutes. It will be resent five times at most, if all fails, a notification letter will be sent to Contact person’s and techical Email mailbox. Please follow the instructions to check the latest status of the order to avoid inconsistent transaction status.

Request Header

| Key | Value |

|---|---|

| Content-Type | application/json |

Request Url

| POST | Url |

|---|---|

| Sandbox | https://{backend_notify_url} |

| Production | https://{backend_notify_url} |

Request Body

| Name | Type | Usage | ||||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| rec_trade_id | String | Unique identifier for this transaction generated by our server. | ||||||||||||||||||||||||||||||||||||||||||||||||

| auth_code | String | Authorization code. Supported only for Direct Pay and Token Pay. | ||||||||||||||||||||||||||||||||||||||||||||||||

| bank_transaction_id | String | Transaction identifier for the bank. We strongly recommend you to define the unique bank_transaction_id by yourself to avoid error 421: gateway time out. |

||||||||||||||||||||||||||||||||||||||||||||||||

| bank_order_number | String | Acquirer’s returned order number after authorization. See reference for supported format/ acquirer. | ||||||||||||||||||||||||||||||||||||||||||||||||

| order_number | String | A self-defined identifier for each transaction. This parameter doesn’t allow null. | ||||||||||||||||||||||||||||||||||||||||||||||||

| amount | Int | Transaction price. | ||||||||||||||||||||||||||||||||||||||||||||||||

| status | Int | Response code. 0 indicates success. | ||||||||||||||||||||||||||||||||||||||||||||||||

| msg | String | Error message. | ||||||||||||||||||||||||||||||||||||||||||||||||

| transaction_time_millis | Long | Time when the bank handles the transaction. | ||||||||||||||||||||||||||||||||||||||||||||||||

| transaction_complete_millis | long | Time when transaction completed (support E.SUN, Cathay Bank) | ||||||||||||||||||||||||||||||||||||||||||||||||

| pay_info | JSONObject | E-payment related information object. Only returned for e-payments transactions. This object is returned by the e-payments provider. If the provider does not return corresponding information, the parameters within this object may be empty strings or zero.

|

||||||||||||||||||||||||||||||||||||||||||||||||

| acquirer | String | Acquiring banks or payment processors. | ||||||||||||||||||||||||||||||||||||||||||||||||

| e_invoice_carrier | JSONObject | Electronic invoice carrier information Support : JKOPAY, Plus Pay

|

||||||||||||||||||||||||||||||||||||||||||||||||

| card_identifier | String | Card identifier. Each credit card corresponds to a unique identifier. Supported only for Direct Pay and Token Pay. | ||||||||||||||||||||||||||||||||||||||||||||||||

| bank_result_code | String(40) | Response code from the bank. | ||||||||||||||||||||||||||||||||||||||||||||||||

| bank_result_msg | String(300) | Error message from the bank. | ||||||||||||||||||||||||||||||||||||||||||||||||

| merchant_reference_info | JSON | Merchant reference information

|

||||||||||||||||||||||||||||||||||||||||||||||||

| instalment_info | JSONObject | When use instalment will return, Only Support: Direct Pay.

|

||||||||||||||||||||||||||||||||||||||||||||||||

| redeem_info | JSONObject | When use redeem and non 3D transaction will return. Only Support : Direct Pay.

|

||||||||||||||||||||||||||||||||||||||||||||||||

| event_code | String(50) | A code which be defined by the bank, E-Wallet and merchants.Support: Easy Wallet, iPass Money | ||||||||||||||||||||||||||||||||||||||||||||||||

| merchandise_details | JSONObject | The item amount or points that are excluded from redeems. Only supported by some e-payments. Please refer to the e-payments support list. |

{

// Example

"amount": 1,

"order_number": "KK44845743",

"status": 0,

"bank_transaction_id": "TP201711088cHQHr",

"transaction_time_millis": 1510136365539,

"acquirer": "TW_LINE_PAY",

"msg": "Success",

"rec_trade_id": "LN201711088cHQHr",

"pay_info": {

"point": 0,

"masked_credit_card_number": "************2178",

"method": "CREDIT_CARD"

}

}

Refund API

- This API allows you to refund your transaction, reversing both the capture action as well as the authorization action.

If partial refund is required, then this API is also needed. - During peak hour, banks might take longer to process the transaction.

To ensure your information is correct, please set your timeout to 30 seconds. - When you call Refund API, TapPay will send the refund request to the banks on the same day.

To confirm whether the captured is succeed, we suggest you check the transaction status on TapPay Portal or call Record API to double confirm the transaction status on the next day. - To make sure the consistence of the transaction result between acquiring banks and TapPay. It’s not allowed to call Refund API during capping time of acquiring banks.

You could call Refund API until TapPay get confirmative transaction results from the acquiring banks. Please wait patiently and refer to the Each bank capture time)to know when could TapPay receives confirmative transaction results from each acquiring banks.

| Name(* = Required) | Type(Max) | Usage |

|---|---|---|

| partner_key* | String(64) | Authentication key for each individual partner. |

| rec_trade_id* | String(20) | Identifier for the transaction being refunded. |

| bank_refund_id | String(20) | Self-defined refund record identifier. (Format : Half-shaped English number and must be unique). If supported by the acquirer, this field will be forwarded. See reference for supported format/ acquirer. |

| amount | int | Only required for partial refund. The amount must include two decimal places(except “TWD”). For example, “100” represents “$1.00” Instalment, T2P transactions do not support partial refunds. |

| additional_data | JSONString(3000) | Data will be encrypted and decrypted when other customization requirements. |

| merchandise_details | JSONObject | The item amount or points that are excluded from redeems. Only supported by some e-payments. Please refer to the e-payments support list. |

// *** Format ***

// Sandbox URL: https://sandbox.tappaysdk.com/tpc/transaction/refund

// Production URL: https://prod.tappaysdk.com/tpc/transaction/refund

// Header:

// Content-Type: application/json

// x-api-key: YourPartnerKey

{

"partner_key": String,

"rec_trade_id": String,

"amount": int // Optional

}

Response

| Name | Type(Max) | Usage | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| status | int | Response code. 0 indicates success. | |||||||||

| msg | String | Error message. | |||||||||

| refund_amount | int | Amount being refunded. Except TWD, transaction price should times 100. For instance, if transaction price is HKD1, will return 100. |

|||||||||

| refund_info | JSONObject | Refund information Points and refund amount information returned by the e-payment. This object is only returned for e-payment transactions, and only certain e-payment providers include this information. Please refer to the e-payments support list.

|

|||||||||

| refund_id | String | Identifier for the action refunded. | |||||||||

| bank_refund_order_number | String | The refund order number that banks or e-wallets send back while refund. See Reference for supported format/ acquirer. | |||||||||

| is_captured | boolean | Whether the transaction has been captured or not. | |||||||||

| bank_result_code | String(40) | Response code from the bank. | |||||||||

| bank_result_msg | String(300) | Error message from the bank. | |||||||||

| currency | String(3) | Transaction currency. Format follows the ISO 4217 alphabetic code, e.g., TWD. Refer to the reference for currencies supported by the bank. |

Record API

This API allows you to get the trade records.

| Name(* = required) | Type(Max) | Default | Usage |

|---|---|---|---|

| partner_key* | String(64) | Authentication key for each individual partner. | |

| records_per_page | int | 50 | Number of records on each page, up to 200. |

| page | int | 0 | The returned page. |

| filters | JSONObject | None | Restrictions on the trade records. The following filters are possible: time* Time frame should be 90 days or less. amount cardholder merchant_id record_status rec_trade_id order_number bank_transaction_id auth_code currency tsp card_identifier |

| order_by | JSONObject | attribute = time is_descending = true |

Criteria for ordering |

// *** Format ***

// Sandbox URL: https://sandbox.tappaysdk.com/tpc/transaction/query

// Production URL: https://prod.tappaysdk.com/tpc/transaction/query

// Header:

// Content-Type: application/json

// x-api-key: YourPartnerKey

{

"partner_key": String,

"records_per_page": int,

"page": int,

"filters": {

"time": {

"start_time": long,

"end_time": long

},

"amount": {

"upper_limit": int,

"lower_limit": int

},

"cardholder": {

"phone_number": String,

"name": String,

"email": String

},

"merchant_id": [String],

"record_status": int,

"rec_trade_id": String,

"order_number": String,

"bank_transaction_id": String,

"currency": String

},

"order_by": {

"attribute": String, // "time"(Order by time) or "amount"(Order by amount)

"is_descending": boolean

}

}

Response

| Name | Type(Max) | Usage |

|---|---|---|

| status | int | Response code. 2 indicates end of list, meaning there are no more records to be shown under the given filter. |

| msg | String | Error message. |

| records_per_page | int | Number of records on each page, up to 200. |

| page | int | The returned page. |

| total_page_count | int | Total number of pages. |

| number_of_transactions | long | Total number of transactions. |

| trade_records | JSONArray | Trade records. |